philadelphia city wage tax refund 2020 deadline

9 rows 2020 Wage Tax refund petition salaried employees PDF Salaried or. Refund applications require an employers signature verifying time worked outside of the city.

Exact due dates for 2020 Wage Tax filings and.

. 2020 tax forms. The Philadelphia nonresident wage tax rate for 2020 was 34481 034481 from January 1 to June 30 and 35019 035019 from July 1 to December 31. Property Tax Relief Programs Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens or disabled persons for property tax increases.

In most cases employers provide the refund petition at the same time they provide employee W-2s or comparable forms. So it is a big deal. Income tax revenues are the citys largest source of revenue for financing the operations of the city.

PHILADELPHIA - Officials in Pennsylvania announce the state is extending its tax filing deadline to July 15 2020. Taxpayers have until May 17 2021 to file and. Please note that the following list does not cover all City taxes since some taxes must be paid through the Philadelphia Tax Center.

Wage File Upload. Electronically file your W-2 forms. About 41 of Philadelphia residents now work outside the city according to a 2020 Center City District report.

Tax types are listed under multiple categories are the same in both places. When is the tax due. June 25 2020 in Client News Alerts by Adrienne Straccione Today the City of Philadelphia Department of Revenue sent an email announcing a wage tax increase for non-residents beginning July 1 2020.

Anyone can also download a copy of the form. Since New Philadelphia is a mandatory filing city the employees in the Income Tax Office review all city income tax returns for residents and businesses. 20 rows 2020 Wage Tax due dates PDF.

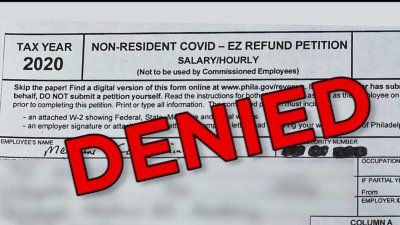

The phones are already ringing off the hook in the citys revenue department. The Net Profits Tax is remitted in addition. Due to the serious nature of.

Click for 1099 Instructions. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia city wage tax is 35019 035019. Electronically file your 1099 forms.

Click for W2 Instructions. At issue are millions of dollars that the city may have to refund to Philadelphia workers who spent the pandemic working from the suburbs. Year-over-year collections dropped 47 to 385 million mostly due to a deadline extension for filing the citys business income and receipts.

Normally Philadelphia non-residents employed in the city can get a wage tax refund for days they worked outside of Philadelphia. Refund requests can be submitted to the Philadelphia Department of Revenue after the end of a tax year or in 2021 for days worked outside the city during the current crisis. So you might think non.

April 2 2020 Philadelphia Extends Filing Tax Payment and Estimated Payment Due Dates and Loosens City Wage Tax Withholding Policy On March 26 2020 the city of Philadelphia issued policy. Live outside Philadelphia non-resident AND. The city wage tax raises 15 billion a year and accounts for about 45 of the citys annual revenue.

The NPT tax rate for 2020 is 38712 of net income for residents or 35019 for non-residents. Philadelphia employers are required to give an income-based Wage Tax refund petition form to employees by February 1. Upload W2 1099 and Wage Tax Refund Request.

The New Philadelphia Income Tax Department administrates the citys income tax law. According to the Philadelphia Department or Revenue non-Philadelphia residents can apply online to request a refund of 2020 wage tax if the worker. Robert Inman a Wharton business economics and public policy professor estimates that Philadelphia has lost 172889 jobs between 1971 and 2001 because of wage tax increases.

If you need to update your address close a tax account or request payment coupons you can use the Department of. There is a statutory exemption for the first 100000 of gross receipts which effectively reduces the. You are responsible for paying 1415 per 1000 of gross income before expenses and 630 on your net income 2020 tax year.

Pennsylvanias Department of Revenue said taxpayers who owe money would not face any further penalties or interest on final 2020 personal income tax returns and payments if they pay by May 17. April 15 and June 15 of each tax year Do you have any tips or suggestions. 5 rows This document amends Philadelphia tax regulations.

Forms instructions Paper income-based Wage Tax refund petition.

Philadelphia Wage Tax Refund Opportunities Tax Year 2020 Baker Tilly

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

Philadelphia Property Tax Due Date Extended To June 15 Department Of Revenue City Of Philadelphia

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Philadelphia Wage Tax Refund Request Form For 2020 Wouch Maloney Cpas Business Advisors

Faqs On Tax Returns And The Coronavirus

City Of Philadelphia Extends Property Business Tax Deadlines Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Refunds Delayed Due To 500 Increase In Applications Nbc10 Philadelphia